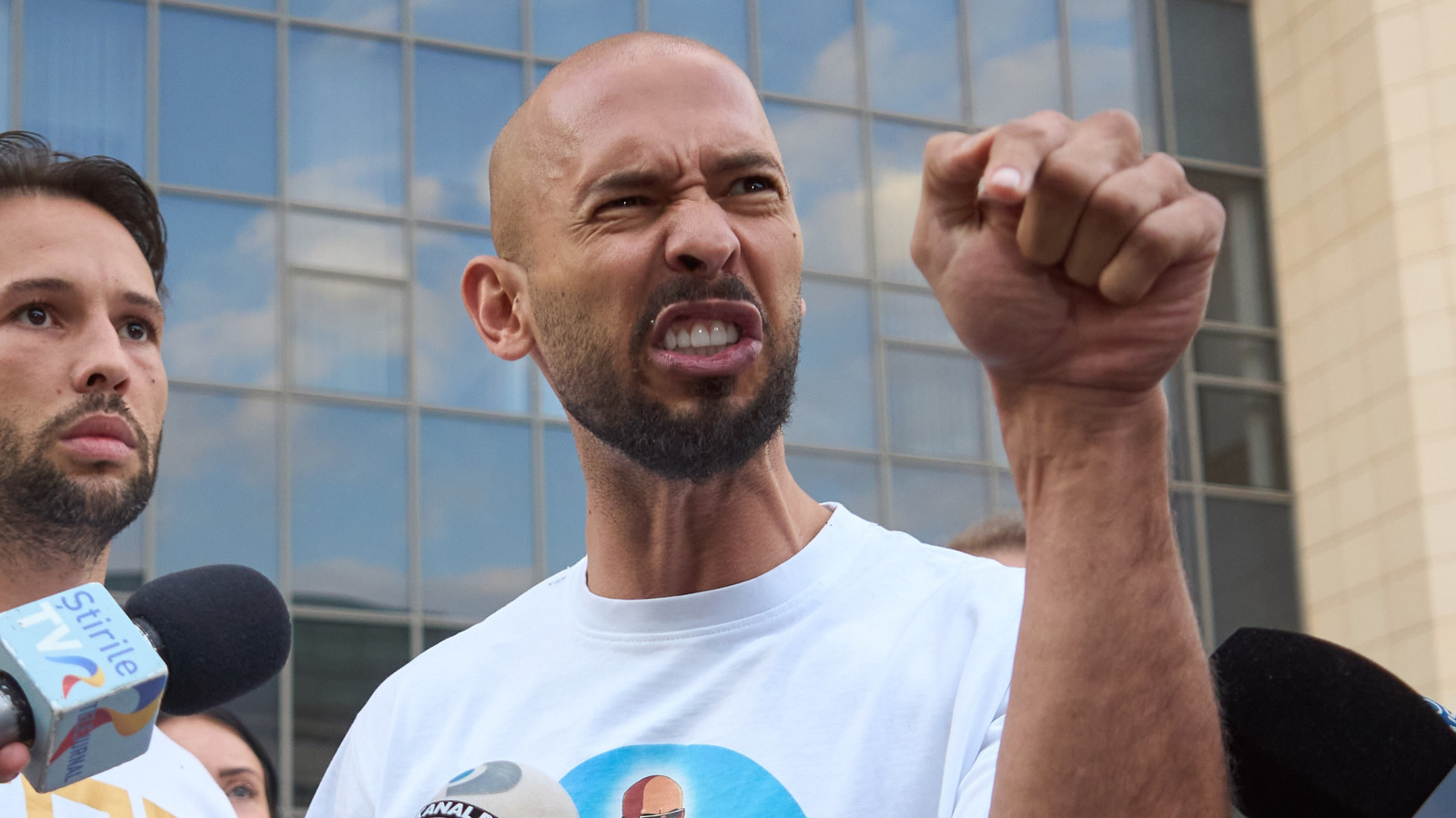

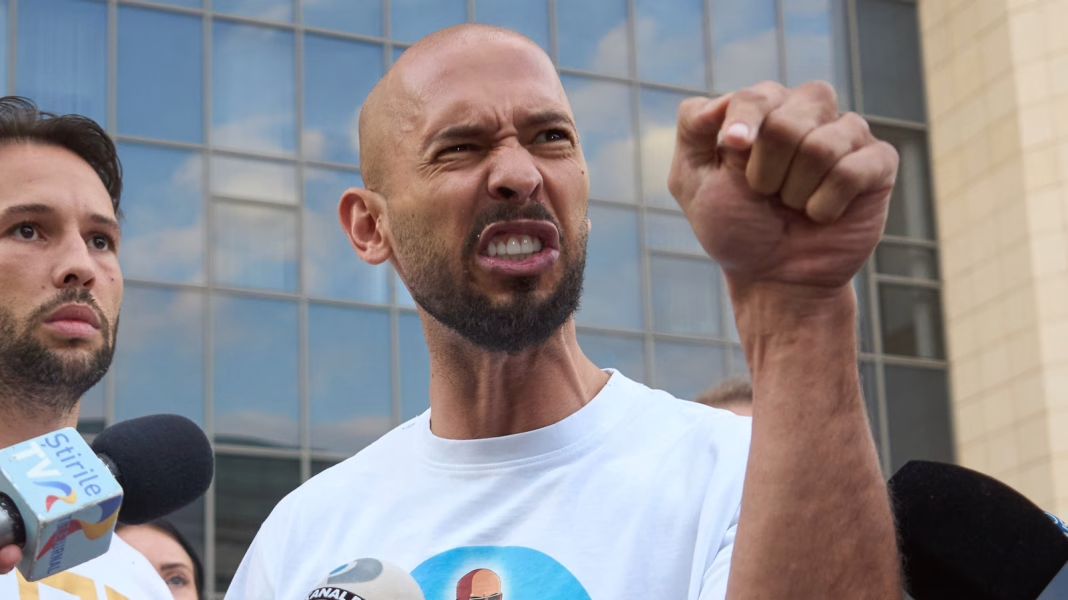

Why Did UK Authorities Seize Andrew Tate’s Aston Martin Valhalla Deposit?

When news broke that Andrew Tate’s hefty deposit for an Aston Martin Valhalla had been seized by UK authorities, a lot of people were left scratching their heads. Why would law enforcement target a car deposit, and what does it say about the broader fight against financial crime? Let’s break down what happened and what it means for anyone following high-profile financial investigations.

What Led to the Seizure of the £180,000 Deposit?

Andrew Tate, a figure who’s never far from controversy, reportedly put down a £180,000 deposit for an Aston Martin Valhalla—a hypercar that’s been generating buzz among car enthusiasts and collectors alike. But before the car could even hit his driveway, UK police swooped in and seized the deposit. The reason? Ongoing investigations into alleged tax evasion and money laundering.

This isn’t just about a flashy car. Authorities often use asset seizure as a tool to disrupt suspected criminal activity. By freezing or confiscating funds tied to possible illegal behavior, they can prevent further movement of money and signal that financial crimes won’t go unchecked. According to the UK’s National Crime Agency, asset recovery is a key part of their strategy, with over £200 million in criminal assets seized in 2022 alone.

How Do Asset Seizures Work in High-Profile Cases?

You might wonder: can the police really just take someone’s money before a conviction? In the UK, the answer is yes—under certain conditions. Laws like the Proceeds of Crime Act 2002 allow authorities to freeze or seize assets if they have reasonable grounds to believe those assets are linked to criminal activity. It’s not about proving guilt right away; it’s about stopping the flow of potentially illicit funds while investigations unfold.

In high-profile cases, this approach serves a dual purpose. It disrupts suspects’ financial operations and sends a message to the public that no one is above the law. For someone like Tate, whose wealth and lifestyle are constantly under scrutiny, the optics of a seized supercar deposit are hard to ignore.

What Does This Mean for Luxury Car Buyers and Sellers?

If you’re in the market for a high-end car, or you work in the luxury auto industry, this story is more than tabloid fodder. It’s a reminder that large transactions—especially those involving cash or international transfers—are increasingly subject to scrutiny. Dealerships are required to conduct due diligence on buyers, and unexplained wealth can trigger red flags.

According to the Financial Action Task Force, luxury assets like cars, yachts, and art are common targets for money laundering. That’s why reputable dealerships now work closely with compliance teams to verify the source of funds and report suspicious activity. For buyers, it’s wise to keep thorough records and be prepared for questions about where your money comes from—especially if you’re making a splashy purchase.

How Common Are Asset Seizures in Financial Crime Investigations?

Asset seizure isn’t just reserved for celebrities or the ultra-wealthy. In recent years, UK authorities have ramped up efforts to target unexplained wealth across the board. The introduction of Unexplained Wealth Orders in 2018 gave law enforcement even more power to investigate and freeze assets when the source of funds can’t be justified.

A 2023 report from Transparency International found that over £5 billion worth of property in the UK is owned by individuals with suspicious or hidden wealth. Asset seizures, like the one involving Tate’s Aston Martin deposit, are part of a broader push to clamp down on illicit finance and recover money for the public purse.

What Are the Broader Implications for Public Perception and Legal Rights?

Cases like this inevitably spark debate about privacy, due process, and the presumption of innocence. Some argue that asset seizures before a conviction can feel like punishment without trial. Others see it as a necessary step to prevent criminals from enjoying the proceeds of their actions while investigations drag on.

Legal experts point out that there are safeguards in place: individuals can challenge seizures in court, and authorities must present evidence to justify their actions. Still, the balance between protecting rights and fighting financial crime is a delicate one, and each case adds fuel to the ongoing conversation.

What Can We Learn from the Andrew Tate Aston Martin Story?

The big takeaway? Navigating the world of high-value assets isn’t about perfection—it’s about smarter adjustments. Whether you’re a buyer, seller, or just an interested observer, understanding how financial crime investigations work can help you stay a step ahead. Start with one change this week—maybe double-check your own financial records or ask your dealership about their compliance process—and you’ll likely spot the difference by month’s end.