Mitsubishi Eclipse Cross debuts as electric crossover with impressive range and fresh design

Electric crossover is a key part of the brand’s renewed line-up – and its mooted return to the UK

Electric crossover is a key part of the brand’s renewed line-up – and its mooted return to the UK

Mitsubishi has unveiled the second-generation Eclipse Cross as a rebadged Renault Scenic, giving the brand a crucial battery-electric model as it effectively relaunches in Europe.

It is differentiated from its French counterpart by styling tweaks such as Mitsubishi’s ‘Dynamic Shield’ grille, flanked by new streak-like daytime-running lights. The rear lights remain the same as on the Scenic but are joined by a new gloss black plastic panel.

Inside, the model gets new seats with diamond-shaped quilting but retains the Scenic’s 12.3in infotainment touchscreen, including Apple CarPlay and Android Auto smartphone mirroring.

Mechanically, the Eclipse Cross is all but identical to the Scenic, with an 87kWh nickel-manganese-cobalt battery pack yielding a range of 372 miles between charges. It can be refilled at up to 150kW at a DC rapid charger or at up to 22kW on an AC connection. A single electric motor sends 215bhp and 221lb ft through the Eclipse Cross’s rear wheels.

A “medium-range” model is set to arrive next year and is likely to use the entry-level Scenic’s 60kWh battery and 168bhp motor.

The Eclipse Cross will be built by Renault in Douai, France.

It is the latest in a run of rebadged Renaults to be launched by Mitsubishi under the firms' Alliance agreement: the entry-level Colt is a Renault Clio; the ASX is a Renault Captur; and the new Grandis is a Renault Symbioz.

Following the cancellation of the Space Star (previously sold in the UK as the Mirage), it means Mitsubishi’s European line-up now comprises just one Japanese-built model, the Outlander.

The brand has yet to confirm plans to return to the UK, but the head of its European operations, Frank Krol, previously told Autocar that it was under consideration.

“If you look at the potential and size of the market, it's our preferred route to go back,” said Krol.

But he added that “we need to have the right product line-up”, pointing to the new Eclipse Cross and the Outlander.

Tesla FSD Faces Safety Concerns After Struggling With Train Crossings

718 EV set to share platform with upcoming Audi Concept C

EV insurance costs set to climb as battery repairs lag behind replacements

EV drivers told premiums will rise until battery repairs are more feasible

EV drivers told premiums will rise until battery repairs are more feasible

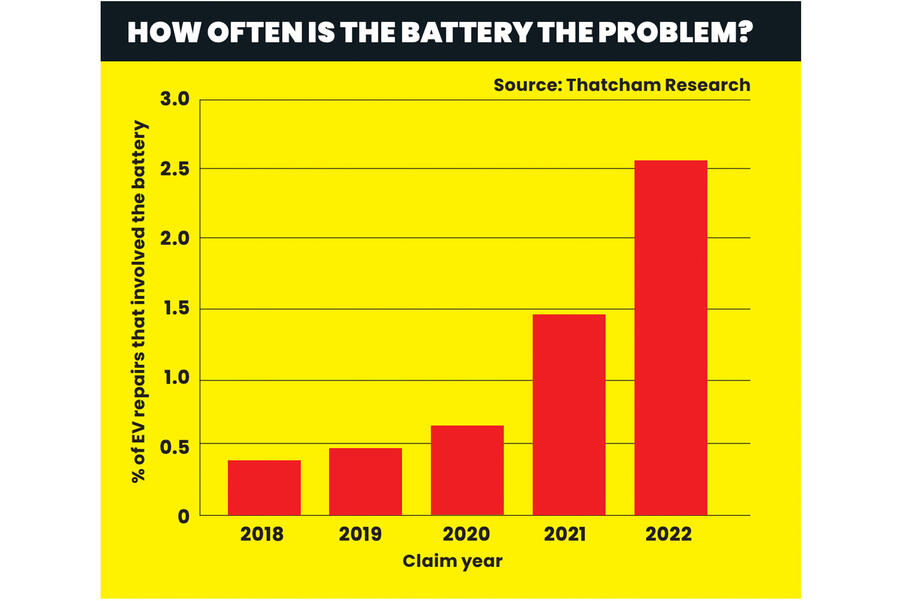

Insurance premiums for electric cars will continue to rise unless the UK can find a cost-effective way of repairing damaged batteries rather than replacing them, warns Thatcham Research, an organisation owned by motor insurers.

This is because the component is worth up to 55% of the value of a new EV – and more as the vehicle ages and depreciates. As a result, some EVs that sustain damage to their battery in an accident are being written off.

While the number of repairs is rising, it remains a very low proportion of total EV repairs, at 2%. Thatcham Research warns that as the number of EVs in the UK increases beyond today’s 1.5 million, it’s essential the UK develops a battery repair and refurbishment industry that will help to keep the costs of claims down.

Dan Harrowell, principal engineer of advanced technologies at Thatcham Research, said: “There’s a lot of discussion around recycling batteries, but as the insurance industry we’re focused instead on the repair, refurbishment and remanufacture of batteries.

“To maintain parity with ICE vehicles, we need battery refurbishment and repairs to be done by independent repairers, as happens in the replacement engine sector. The risk is that unless industry develops the skills to do this work, as we hit scale and as EVs age, writeoffs will be more considerable.”

Insurers are also concerned that replacing a damaged battery with a new one puts a policy holder in a better position than they were before their accident, because the car will be worth more with a new battery fitted.

“This falls into the debate the industry is having about ‘betterment’,” said Harrowell. “Refurbishment to a level equal to the original battery would solve a lot of our challenges.”

There are signs the industry is taking notice. In March, Cox Automotive and DHL combined to launch a centre for the repair and remanufacture of EV batteries for fleets. Located in Rugby, the 35,000sq ft facility has the capacity to process thousands of batteries a year.

Paul Stone, managing director of DHL Supply Chain UK, said: “This cooperation represents a major step forward in creating a scalable circular economy for batteries in the UK.”

Meanwhile, Grantham-based Autocraft Solutions, a remanufacturer of engines, is also repairing and refurbishing EV batteries. However, crucially for insurers concerned about betterment, it is restoring them to the condition they were in immediately prior to their failure.

“We accept that batteries don’t go back to exactly the way they were when new because of the way their chemistry changes,” said Autocraft engineering and quality director Sara Ridley. “Instead, we aim to put them back as close as possible to where they should be for the age and type of battery.”

The company is repairing and refurbishing up to 3000 batteries a year. Each is around 50% cheaper than its new equivalent but this saving varies according to how long it takes to repair.

Ridley said: “Batteries are being prematurely scrapped because people don’t know what’s wrong with them or whether they are safe. We can establish this and fix them. Insurers need that confidence.”

Mercedes GLE Engine Failure After Oil Change Leads to Shocking Repair Bill

Spirit Airlines pilot ignores warnings and flies dangerously close to Air Force One

Polestar embraces bold car features as 80 percent of drivers adapt and love the...

Swedish EV brand designs divisive but memorable cars, says CEO Michael Lohscheller

Swedish EV brand designs divisive but memorable cars, says CEO Michael Lohscheller

Polestar is happy to have polarising features on its cars as a way of standing out against the competition.

These include the likes of the lack of rear window on the Polestar 4, which instead has a camera to give the driver a digital rear view.

At the recent Munich motor show, CEO Michael Lohscheller told Autocar: "80% of the customers get used to very quickly and then they like it – but I will say there are also people who don't like it.

"So in a way, the car is polarising, which sometimes is really, really good, because you don't want a car that is 'kind of all right'.

"Everybody has a 'kind of all right' car, but you want a very specific car. That's what the Polestar 4 is doing: there are people who drive it and love it, then there are 20% who say 'it's absolutely not for me'.

"But that's okay; it's totally okay. We don't want a car where everybody says, 'well, I kind of like it'. No, you have to love it or not.

"So I think actually [the 4] is an exceptionally successful [design]."

Lohscheller said the new Polestar 5 continued the trend for the Swedish brand of "making a statement" in its positioning and execution.

It also continued a trend for Polestar in being based on a different platform to other models in the range, meaning all five Polestars to date have been built on different underpinnings.

Lohscheller said that trend would change and the brand "would harmonise over time" and launch more related models.

The European-built Polestar 7 smaller SUV and next-generation Polestar 2 are likely to be the first to share a platform.

"The more you standardise, the better your quality," Lohscheller added.

More broadly on European production, Lohscheller said it will reduce Polestar's CO2 footprint by bringing local production to its largest market. It will also allow it to get its cars to customers quicker in the UK, its biggest single market.

He remains committed to the brand's 'asset-light' business model, which means sourcing platforms, technology and factories in which to build cars from other companies.

This will be "the future of the automotive industry", according to Lohscheller, in order for car companies to be more efficient and leverage more from each other.

Lohscheller was speaking just days after Polestar posted a quarterly loss of more than $1 billion, including a write-down cost in excess of $700 million on the US-built Polestar 3, due to the impacts of weaker than expected sales and US trade tariffs.

He insisted his focus is on the operational business and said that revenue growth of 56%, a positive gross margin for the first time and reduced costs are signs that Polestar is heading in the right direction in terms of establishing itself as a profitable business.

"The underlying operational business clearly improved in the first half of the year," he said. "That's good to see."

Dodge Durango Hellcat Crushed by Police in Bold Crackdown on Street Racing

Boeing Faces 3.1 Million Fine After 737 Max Door Plug Blowout and Safety Interference

Mustang crash at car show narrowly misses crowd and flips after wild spin