Chinese automakers are leading the charge in the electric vehicle (EV) revolution, and it’s not just because of innovative designs or cutting-edge technology. The secret sauce? A hefty dose of government subsidies. As the world shifts towards greener transportation, China has positioned itself as a formidable player, leaving many Western brands scrambling to catch up. Let’s dive into how this financial backing has shaped the landscape of the EV market.

How Are Chinese Automakers Dominating the EV Market?

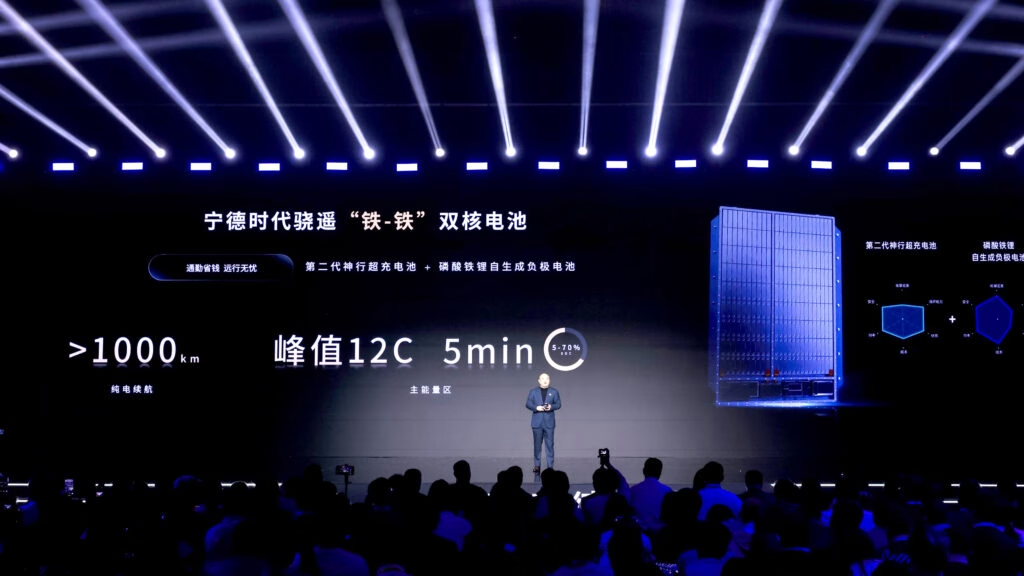

It’s no secret that Chinese automakers have surged ahead in the EV race. Companies like CATL, BYD, and Great Wall Motor (GWM) have not only embraced electric technology but have also benefitted immensely from state support. In fact, CATL, the world’s largest EV battery manufacturer, has received staggering amounts of government funding—more than any other company in the sector.

In the first half of 2024 alone, CATL raked in approximately 3.84 billion yuan (around $532 million) in subsidies. To put that in perspective, this amount is nearly equal to what Sinopec, a state-owned oil giant, received for the entire year. This financial advantage has allowed CATL to innovate rapidly and expand its production capabilities, giving it a significant edge over competitors.

What About Other Key Players?

CATL isn’t the only beneficiary of this financial windfall. BYD, another major player in the EV market, received about 3.8 billion yuan (approximately $527 million) in subsidies last year. This financial support has undoubtedly played a crucial role in BYD’s ability to launch multiple new models at an impressive pace.

GWM and SAIC Motor also enjoyed substantial subsidies, with GWM receiving nearly 3 billion yuan (~$416 million) and SAIC Motor getting over 2 billion yuan (~$277 million). This influx of cash enables these companies to invest in research and development, lower their prices, and ultimately capture a larger share of the market.

Why Is This a Concern for Western Brands?

The sheer scale of subsidies provided to Chinese automakers raises eyebrows globally. As these companies benefit from government support, they can offer their vehicles at lower prices, making it challenging for Western brands to compete on an even playing field. This has led to frustration among U.S. and European manufacturers, who are struggling to keep pace without similar levels of government backing.

The implications of this financial strategy extend beyond just market competition. It raises questions about the sustainability of such practices and the long-term effects on global trade dynamics. As the EV market continues to grow, the need for a level playing field becomes increasingly critical.

What’s Next for the EV Landscape?

As the competition heats up, it’s clear that the EV market is evolving rapidly. The financial backing that Chinese automakers receive is likely to continue fueling their growth, but it also prompts a call to action for Western brands. They need to innovate, adapt, and perhaps even advocate for more supportive policies to remain competitive.

The big takeaway? The rise of Chinese automakers in the EV sector isn’t just about their technological prowess; it’s also about strategic financial support. For consumers and industry stakeholders alike, this evolving landscape presents both challenges and opportunities. The future of electric vehicles is bright, but it’s essential to keep an eye on how these dynamics play out in the coming years.