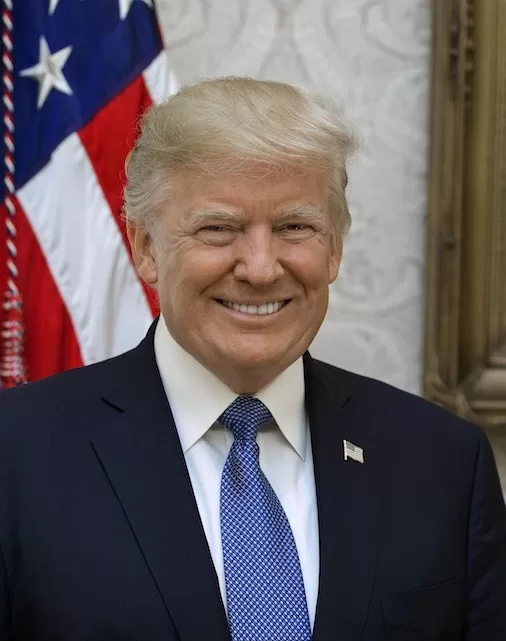

US presidential election campaigns on both sides of the spectrum will soon be underway, with initial polls showing Donald Trump entering the race with a 3% advantage over Joe Biden.

As voters shift from incumbent Joe Biden to the fiery Republican, who wasn’t considered a serious contender by the US liberal media as recently as six months ago, the prospect of a Trump victory is starting to send ripples through the business community.

Donald Trump has traditionally backed big oil and taken an anti-climate change stance and these policy positions are likely to intensify should he be elected in November 2024. In this article we take a look at the prospect of another Trump presidency and his potential impact on the international resources market.

The second Trump presidency: a boon for the resources center?

At first glance, Donald Trump seems like the perfect president for major players in the resources sector. The presumptive Republican candidate has a long history of supporting major oil producers and has always taken a stance against green energy and climate change despite mounting scientific evidence to the contrary.

However, comment Trump policies may not turn out to be beneficial to the resources sector across the board. Companies in oil sector may stand to benefit while green manufacturers could lose the incentives they’ve been enjoying under Biden policies.

Since Joe Biden was elected in 2020, conservatives have been drafting and refining wide-reaching policies to combat the green energy movement.

Some of their suggestions include defunding the Environmental Protection Agency, putting a stop to green energy initiatives and subsidies, withdrawing from the $3 billion climate fund, and doubling down on Trump’s traditional support of US oil companies and fracking firms.

If Donald Trump’s intentions regarding the oil industry weren’t clear enough, the Republican forerunner’s recent charm offensive toward energy company CEOs have left very few doubts about his future policy intentions.

After Harold Hamm, head of Continental Resources, backtracked on his previous support for Ron DeSantis and arrived at Mar-a-Lago with a $200,000 donation for Trump 2024, a flood of big energy chiefs have made the pilgrimage to Florida to dine with The Donald and pledge their support for his pro-oil policy framework.

Trump has long been a climate change skeptic and a supporter of traditional American industries like auto manufacturing and oil extraction, citing their ability to create jobs for average citizens and not only the educated elite – as he defines knowledge workers.

The possible results of shifting US green energy policy

Should Trump prevail in 2024, the resource sector may be in for a shakeup. Some of the changes to expect include:

- The rolling back of subsidies for hybrid vehicles and green energy generation for homes and businesses.

- Substantial tax cuts for traditional energy companies, auto manufacturers, and factories.

- A legislative environment that no longer incentivizes sustainable resource production and use, potentially causing chemical companies who have benefited from the Biden era green incentives to become less profitable.

Overall, the second Trump presidency will probably be extremely good news for oil companies and traditional resource producers who have not yet switched over to sustainable manufacturing practices while penalizing those that have – but what are his real odds of winning? Currently, Presidential Elections odds have placed Trump’s chances of victory at +135, favoring the strapping former president over an increasingly frail seeming Joe Biden.

Yet, a further risk factor that the resource sector should bear in mind is Trump’s promise to impose large tariffs on imported goods and materials from abroad.

Will the Trump tariffs benefit the chemical industry?

The Trump 2024 campaign has already presented a raft of controversial policies set to be implemented should the campaign emerge victorious in the 2024 election.

Among these, one of the proposals that is most concerning to the private sector is the proposed 10% tariff on all imports. This is supposedly designed to protect US manufacturers and encourage domestic industries at the expense of foreign manufacturing powers like China, Japan, and even the European Union.

This huge tax burden would immediately make foreign products more expensive than local alternatives.

Tariffs may also be applied to raw materials, with experts expecting the policy to result in a decline in GDP of between $60 to $120 billion per year or more, with the prospect of tariff retaliation by other nations increasing the cost of doing business for US exporters. This outcome could be disastrous considering that the policy is supposed to benefit American manufacturing.

From the resource industry’s point of view, tariffs creating trade barriers with the world’s biggest economy are never welcome news. While some US manufacturers- including those who produce or rely on chemical compounds, plastics, and fossil fuels – may benefit from reduced competition, increases in raw material costs and a looming trade war may erase these gains.

Final Analysis

It may be too soon to predict the 2024 US presidential election with any degree of accuracy, but as Donald Trump edges ahead of Joe Biden the scenario of a second term for the controversial Republican is becoming more likely.

Trump’s pro-oil and anti-green tendencies will certainly have an impact on US policy should he be elected, with traditional resource businesses and manufacturers benefiting at the expense of green industries.

Industrial analysts and key players in the chemical sector should keep a watchful eye on polling and election results as they plan their response to a rapidly changing U.S. policy environment.