Lotus Emira Clark Edition: A Tribute to Racing Legend Jim Clark’s Legacy

New £115k variant of V6 sports car commemorates 60 years since Jim Clark’s final Formula 1 world title

New £115k variant of V6 sports car commemorates 60 years since Jim Clark’s final Formula 1 world title

The Lotus Emira Clark Edition has been revealed as a celebration of legendary racing driver Jim Clark.

Based on the range-topping Emira V6, it features the ‘Clark Racing Green’ and yellow-striped livery used by the Scotsman’s race cars in his famed 1965 season, when he won the Formula 1 World Championship and the Indy 500, as well as other global series.

The exhaust pipes are painted in the same yellow, referencing the design that was applied to the Lotus 38 in which he won at Indianapolis.

Inside, the Clark Edition Emira gets two-tone black and bright-red upholstery, with the latter shade applied only to the driver’s side of the cabin, in reference to the interiors of Lotus’s historic race cars.

A piece of the Clark family tartan (from Lochcarron of Scotland) can be found in a commemorative plaque in the seat’s headrest.

The metal gearknob found in the regular Emira has also been replaced by a wooden item.

Meanwhile, the sill treadplates are now carbonfibre items that reference the car’s position in the production run of 60 Clark Editions – a number chosen to reflect how many years have passed since that 1965 season.

The Clark Edition is mechanically unchanged from a regular Emira V6, so its 3.5-litre supercharged powerplant sends 399bhp to the rear wheels via a six-speed manual gearbox and a limited-slip differential. The special edition is also fitted with the Lotus Driver’s Pack, which is optional on the regular Emira and brings firmer sports suspension, switchable exhaust and a Track driving mode.

Prices start at £115,000.

Clark’s 1965 season is considered among the greatest ever individual seasons for a driver, having also won titles in the Tasman Series and British and French Formula 2 championships, and overall wins at Brands Hatch and Oulton park in the British Saloon Car Championship (forerunner to today’s BTCC). The Scotsman was killed three years later in a crash at Germany's Hockenheimring and is remembered as a sporting legend.

Hyundai Breaks Sales Records with Strong Demand for Tucson and Santa Fe

Mustang GTD Shatters Nürburgring Record with Unmatched Speed

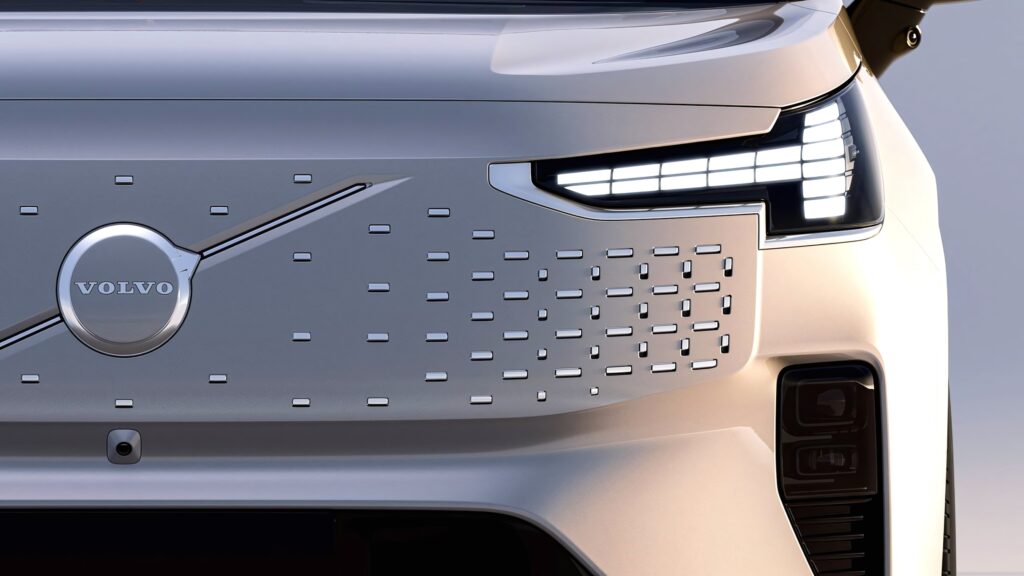

Volvo’s Bold Shift: Building More Cars in America Amid Tariff Challenges

Embracing the Quirky Charm of the Fiat 500L: A Standout Choice for Fun and...

Reviving Classics: Meet iCaur, the Bold New Contender in Off-Roading

iCar majors on customisation: this example mimics Land Rover's Camel Trophy competition carsChery-owned 4x4 brand's 'salute to the classics' will now look to rival them – and on their home turf, too

When Renault Group CEO Luca de Meo visited Chery earlier this year, he was shown the full line-up of cars from its multiple brands.

Like most large Chinese car companies, Chery’s brands attack nearly all sectors, from practical family SUVs to slippery electric premium saloons.

But the car the Italian executive walked up to first was the chunky little iCar V23 off-roader. “He just loved the concept,” according to someone who watched his reaction.

Global CEOs going on fact-finding trips to China is a common phenomenon these days. Witness Ferrari CEO Benedetto Vigna’s recent visit to Leapmotor. De Meo’s visit may or may not indicate a broader tie-up between Renault and Chery, but it does show how iCar is prompting visceral reactions with a smart take on an age-old concept heading right back to the original Land Rover and Willys Jeep.

If Brits know Chery at all, it’s mainly from the new Omoda and Jaecoo brands, which are steadily heading up the sales charts with keenly priced petrol, plug-in hybrid and electric SUVs.

It also has a tie-up with JLR in China, giving it insight into the world’s foremost expert in off-roaders.

Chery’s export ambitions don’t stop at Jaecoo and Omoda. Also heading to the UK as part of a global push are the new Lepas value brand, models in Chery’s Tiggo family SUV range and iCar – which has had to be renamed iCaur to avoid trademark battles with Apple. It makes more sense on the badge, where the ‘a’ links cursively with the ‘r’ to form the ‘u’.

Sales of both fully electric and range-extender EVs from the brand are expected to start here next year as part of iCaur’s ambition to open 2000 showrooms in 100 countries within three years.

Chinese brands have a history of overpromising and underdelivering, but Chery is so far proving an outlier, having gone from zero Omoda and Jaecoo dealers at the start of 2024 to just under 80 now in the UK, with 120 planned for the end of the year.

The electric-only V23 is the iCar global launch product and now defines the brand, after a false start and a swift change of direction to focus on chunky, playful, characterful go-anywhere utility vehicles.

The off-roader's footprint is small, at 4220mm long and almost as tall as it is wide. The windscreen is nearly flat and the slab sides point straight up, giving plenty of room inside.

The clamshell bonnet, inboard round headlights, chunky wheel arches and blocky details are at once familiar without directly referencing any previous vehicle.

Brand CEO Su Jun described the look “a salute to the classics” at the recent Shanghai motor show.

“The box style is a classic style,” Su told Autocar on a recent trip. “Suzuki Jimny, Jeep, [Mercedes] G-Class… It has some of their elements mixed together but doesn’t copy them.”

Those round headlights inboard lights are a reference to the 1960s Chinese army BAW BJ212 ‘Beijing Jeep’ that replaced a Russian Gaz.

The V23 costs from the equivalent of just £11,200 in China, that for the two-wheel-drive version with a 60kWh battery, thanks mainly to the country’s fierce pricing environment, but even double that would represent value in the UK.

More models are coming. Autocar was given a sneak preview of the 4.8m-long V25, launching later this year, which will have the company’s first range-extender powertrain: a 1.5-litre turbo engine generating energy for a 22kWh or 33kWh battery.

As with the V23, we’re promised the off-road ability will cash the cheque written by its go-anywhere look, with more expensive versions coming with twin electric motors to make it four-wheel-drive.

UK sales are slated from 2026, when the V25 will pose a serious threat to the ambitions of Ineos, which had to shelve plans for its own range-extender EV, as well as attacking the Toyota Land Cruiser and planned new Land Rover 'Defender Sport'.

In 2027 we can expect the V21, a small Jeep Avenger rival that will be electric-only and could offer a two-door body. Also in 2027, a large SUV badged V29 is scheduled to provide a cut-priced alternative to the Defender and Ineos Grenadier.

iCar is capitalising on a blooming trend for chunky off-roaders in China, sparked by the Defender and Ford Bronco and then fuelled by the sweeping fashion for outdoor activities, partly as people dreamed of escape during the long confinement of the Covid pandemic.

Foreign automotive executives have watched amazed at the transformation of the car market to accommodate new tastes.

“I lived in China for several years, and there were many trends we see now that we thought would not happen in China,” BMW product chief Bernd Körber told Autocar.

“Ten years ago, it was unthinkable that the Chinese would move into camping, but [now] it's a huge trend and there's a huge affinity for outdoor car concepts."

This year’s Shanghai show was crammed with chunky new off-road production models and concepts, including from MG, Hongqi, Geely’s Galaxy, Changan and Baojun.

But iCar and fellow Chery brand Jetour (which majors on ICE off-road SUVs) are set to capitalise the fastest. iCar only came into existence in 2023, but its coming-out party at that year’s Shanghai show envisaged a very different plan for the future.

Back then, the brand's 03 SUV was a more modernistic take on the box shape, while also on the stand was a GT sports car concept. The brand’s press conference referenced six new cars, including people carriers.

Back then, iCar to be was a new ‘smart EV’ brand following the likes of SAIC’s IM, Geely’s Ji Yue, Xpeng, Nio etc.

Su Jun is also the CEO of Smartmi, a home appliance brand known for the production of air purifiers, fans and robot vacuums linked to the Xiaomi digital ecosystem.

The 4.4m-long electric 03 was launched and is still on sale, but the V23 marked a change of direction for the brand.

Its Shanghai stand this year featured myriad V23s modified with different paint jobs, personalised extras, concept bodyshapes (including a pickup and canvas-roof convertible) and one wrapped in pink fur. The 03 was nowhere, V23 everywhere.

“This car is our pure style,” Su said.

Personalisation is a key part. The V23 features 24 modular components, removable wheel arches, interchangeable bumpers, Lego-inspired high brake lights and decals to affix to that van-like rear. You can choose from a huge range of accessories, some of which affix to the car, including a sort of cage for the top of the dashboard to attach phone holders or dashcams.

The insane pace of the Chinese car market means trends can also die as quickly as they started, but the brands are nimble and fast enough on development speeds to react.

The iCar 03, for example, on sale for less than two years, has now been fitted with a range-extender drivetrain and will be sold as the Jaecoo 6 in export markets.

Chinese car customers could tire of chunky utility vehicles just as fast, but markets such as Europe have long admired the classic box style.

With pure-electric and range-extender EVs giving iCar models access to tax advantages and lower fuel bills that, for example, Suzuki with the Jimny and Ineos can’t tap into, the brand could have a longer shelf life abroad than at home.

Su Jun: the rare Chinese car executive who likes buttons

The iCar V23 has all the smart tech you would expect of a modern Chinese electric car, including a massive 15.4in touchscreen. But look below that and you see that rarity: three metal dials controlling the volume, drive modes and heating/cooling.

“I love them, I crazy love them,” iCar CEO Su Jun tells Autocar. The reason is part convenience, part nostalgia. “When I was a student, we used cassette machines from Sony or Panasonic with lots of dials, lots of buttons, so we have a memory for them,” he said.

Su is a former industrial designer who rose to fame after founding the Smartmi internet-connected home appliance brand, a sort of Chinese Dyson.

Tech companies such as Baidu, Xiaomi and Huawei have all engaged with the car industry in China, but Smartmi is different in that it produces physical objects rather than apps or software, and the difference is notable in the tactile quality and details of the V23.

Su reckons authenticity is key even if most cars will never leave the Tarmac, let alone trouble their 600mm maximum wading depth (double that of the Jimny).

“Most of the time, people have no need for the off-road car, but they like the spirt, so we keep that and keep the ability,” he said.

Subaru’s Sales Struggles: BRZ Shines Amidst Overall Decline

Transform Your Driving Experience with This Honda-Swapped Lotus Elise

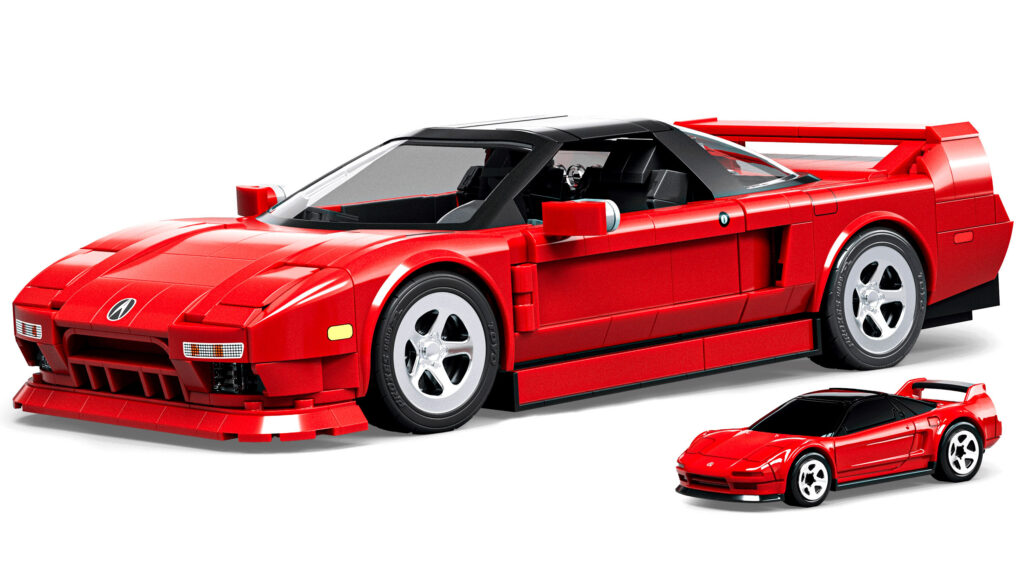

Mattel’s Brick Shop: A New Era of Buildable Hot Wheels Adventure

Exploring the Wild World of Bosozoku: A 1976 Documentary Journey