Jeep Wrangler 4xe Lease Looks Cheap Up Front but Hidden Costs Add Up Fast

Suzuki logo gets a modern makeover with flat design for the digital age

Mechanical Failure Suspected in Small Plane Crash at Lime Rock Park

Prologue discounts lead the way with up to twenty thousand dollars in savings on...

Jeep Gladiator 4xe Canceled Before Hitting the Market

Porsche 718 Returns With Gas Power as EV Plans Shift

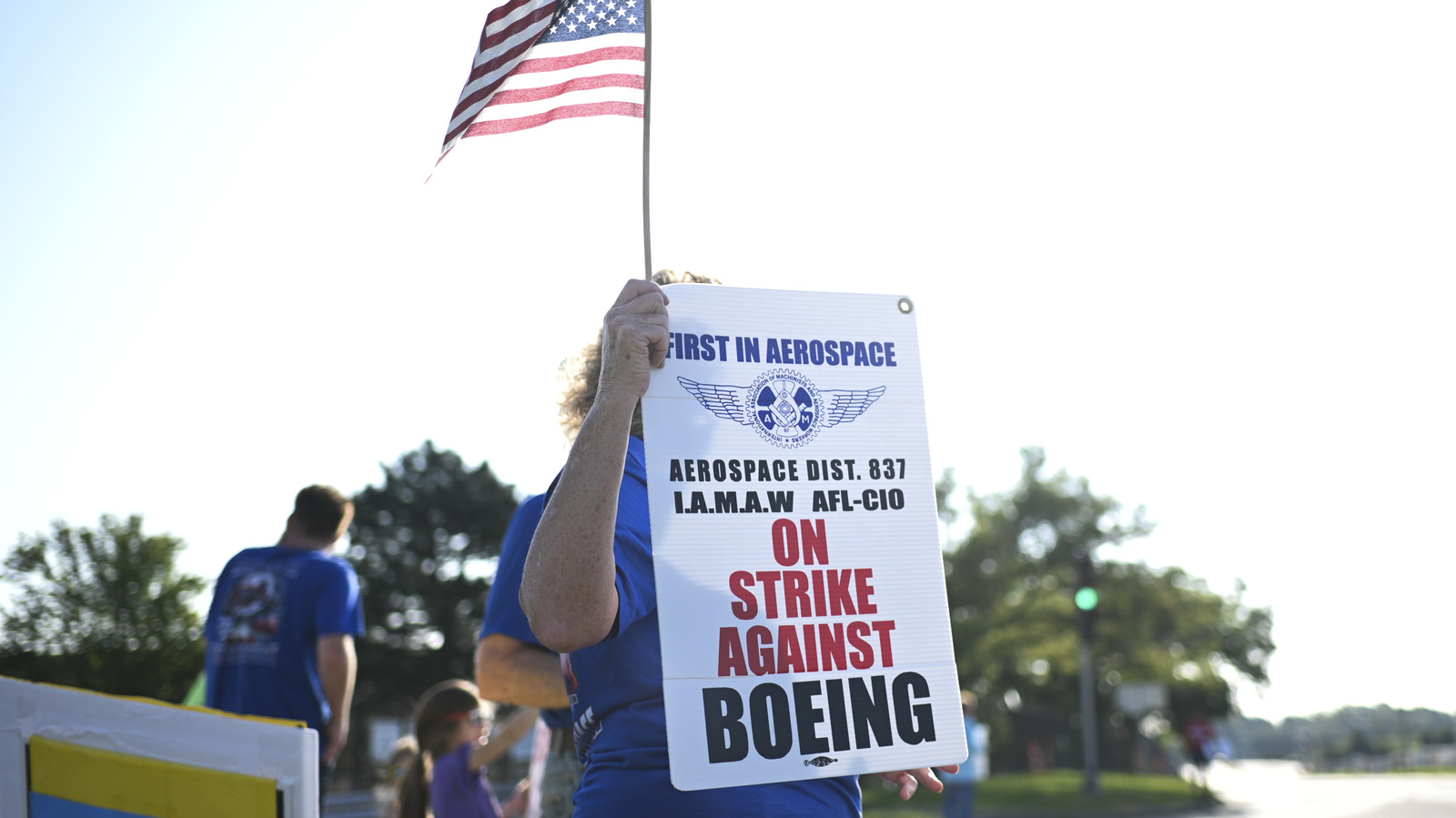

Boeing Worker Pay Cuts Lead to Fewer Planes Built

Bentley Delays Electric Shift as Petrol Models Get New Lease on Life

Bentayga, Continental GT and Flying Spur are now set to be renewed with petrol engines rather than go electric

Bentayga, Continental GT and Flying Spur are now set to be renewed with petrol engines rather than go electric

Bentley is readying pure-petrol successors to the Bentayga, Continental GT and Flying Spur in a reversal of its EV-only plan, brought on by drastic U-turn at Porsche late last week.

Under its Beyond100 strategy, the British luxury car maker planned to phase out petrol engines entirely by 2035. But it's now set for significant alterations as its Volkswagen Group sibling firm doubles down on renewed commitments to ICE development.

Porsche confirmed on Friday that it will commit €3.1 billion to extend the life of its ICE models. This notably includes new “top” models of the next-generation 718 Boxster and Cayman and no longer selling the planned ‘K1’ flagship as an EV.

Fellow Volkswagen Group firm Audi cancelled its plan to go electric-only by 2033 last year.

Bentley CEO Frank-Steffen Walliser told Autocar that as the three brands share platforms, drivetrains and other key components, decisions and investments in Stuttgart and Ingolstadt have had direct consequences in Crewe.

He confirmed that Bentley still plans to launch a new plug-in hybrid or electric model every year from 2026, beginning with its first EV, an "urban SUV". But with Porsche and Audi continuing to invest heavily in ICE technology for their best-sellers, he said Bentley now has scope to balance its drivetrain mix more towards traditional petrol power further into the next decade than originally anticipated.

As such, pure-petrol successors to the Bentayga, Continental GT and Flying Spur are set to remain part of the line-up, reflecting demand from key markets such as the Middle East and North America. They were originally expected to be offered only with PHEV or EV powertrains.

Backing the decision, Walliser said: “There is a dip in demand for luxury electric vehicles, and customer demand is not yet strong enough to support an all-electric strategy. The luxury market is a lot different today than when we announced Beyond100.

"Electrification is still our goal, but we need to take our customers with us.”

Despite the change in tack, investment in Bentley’s Crewe facility is pressing ahead, with a new electric model assembly line, paint shop and design centre under construction.

Bentley had already pushed back its target for becoming an all-electric brand from 2030 to 2035, citing slowing demand in the luxury EV market.

The Volkswagen Group’s new direction and multi-billion-euro investments in ICE models are expected to reinforce that decision.

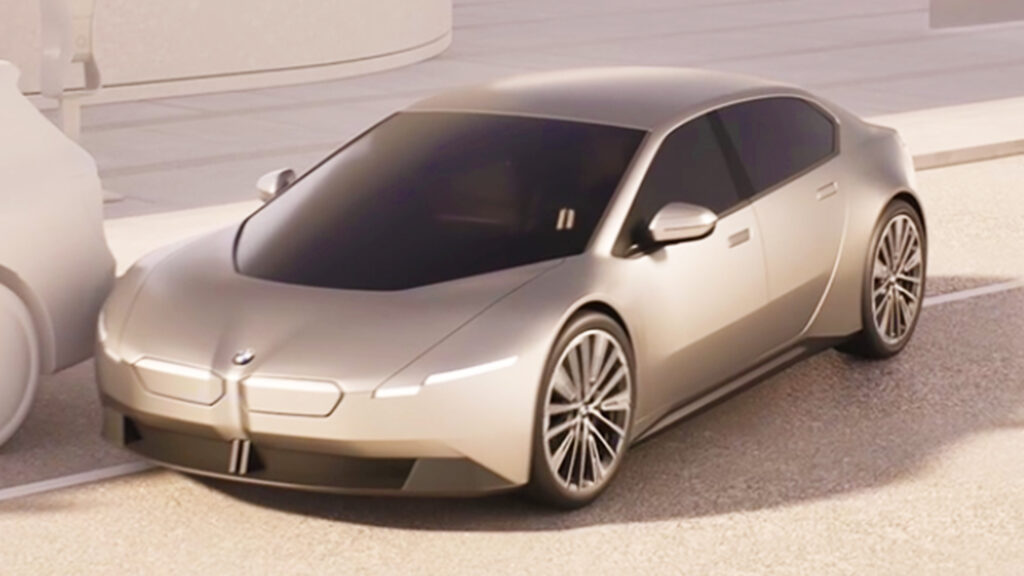

BMW EV concept sparks speculation with mysterious sporty sedan on official site

Porsche rethinks EV plans as Stellantis speeds up electric shift with new battery tech