Why Car Makers Are Replacing Carbon Fiber With Sustainable Flax Composites

Manufacturers like BMW will use flax-fibre parts on upcoming production models

Manufacturers like BMW will use flax-fibre parts on upcoming production models

After using a sustainable, natural-fibre composite in motorsport for a number of years, BMW has announced it will be using the flax-based material, developed by Swiss firm Bcomp, on future production models. In testing, the material has proved suitable for a range of uses, including visible A-surface finishes on the interior and exterior.

Several years of R&D have found that composites made from renewable materials are not only able to create attractive surface finishes, but they can also be used for structural components.

An example is the roof panel in next-gen cars, where renewable fibre composites can reduce CO2 equivalent by 40% during production, and it gives end-of-life benefits.

BMW’s venture capital arm, I Ventures, holds a stake in Bcomp, which was founded in 2011 to make high-performance skis using flax fibres, and Bcomp became an official BMW Motorsport partner in 2022. Its woven fabric Amplitex is made from European flax fibres, sourced from the plant of the same name.

Weaves can vary for different uses and visual effects, and it comes either as fabric or impregnated with thermoplastic resin (prepreg). Structural panels can be reinforced with ‘Powerribs’, a grid-like mesh also made from flax fibres and bonded to the mat.

BMW first used reinforcement parts made from the natural fibre material in its 2019 Formula E cars, followed by the M4 DTM as well as the M4 GT4, replacing carbonfibre-reinforced plastic (CRFP). The M4 GT4 was equipped with parts made from the new materials for the Nürburgring 24 Hours.

Bcomp says that depending on application, the ‘cradle to gate’ (extraction of raw materials to leaving the factory) CO2 footprint can be up to 85% lower compared with conventional composites. Some components can be 50% lighter and reduce the use of plastic by 70% – thermoplastic Powerribs can meet those weight- and plastic-reduction criteria for interior panels.

Bcomp is also working with a number of other car makers. Cupra is using its materials in seats, Kia has used it on the interior of the EV3 and EV4 concepts, Polestar in the Polestar 3, Volvo on the Concept Recharge and Porsche has used it in the 718 Cayman GT4 Clubsport for wings and doors.

Along with its announcement, BMW released images of prototype roof panels, a rear diffuser and cabin trim.

Elsewhere, Karuun, a material made from rattan by German firm Out for Space, was used by Nio in its Eve concept back in 2017. It was later used in production in the ET7 and EC7 as a trim material. Karuun Stripe, a rattan veneer, is used in Porsche’s Macan Electric for its Nature Tech Material interior trim options.

AI Car Tech: Which Features Drivers Love—and Which Still Frustrate

Near-Miss Shocker Reveals Urgent Need for Safer Skies

Leapmotor Unveils Affordable Electric Hatchback Promising 260 Mile Range and Bold Design for Young...

Latest EV from Stellantis-backed Chinese manufacturer is set to offer 260 miles of range and 215bhp

Latest EV from Stellantis-backed Chinese manufacturer is set to offer 260 miles of range and 215bhp

Leapmotor has previewed its upcoming Volkswagen ID 3 rival ahead of a debut at the Munich motor show next week.

The Stellantis-backed Chinese brand published a series of shadowy teaser images to its Weibo account, giving a first look at the sub-£30k B05 electric hatchback that will join its European line-up early next year.

Known in China as the Lafa 5, the B05 is effectively a lower-slung and more affordable version of the Leapmotor B10 crossover (due here in the coming months) and will sit between that and the T03 city car.

Leapmotor vice-president Cao Li said the B05 is a "gift" for young people worldwide. "We want to build a dream car for young people who refuse to settle, conform or be ordinary," he added.

The B05 is expected to measure around 4.3 metres long, have a 67.1kWh battery giving 260 miles of range and be powered by a single motor on the front axle giving 215bhp.

These figures line it up neatly as a rival to versions of the popular ID 3, MG 4 EV, BYD Dolphin and Renault Megane.

Inside, it is likely to look all but identical to the B10 (below), having a minimalist cockpit that majors on digital functionality - with a 14.6in touchscreen and 8.8in instrument display handling all the main infotainment and control functions.

The B05 will be the fourth of six Leapmotor cars that are planned to be on sale in the UK by 2027. It will be followed next year by the A10, a small crossover conceived as a rival for the Volkswagen ID 2X, and its hatchback sibling, the circa-£20k A05.

It remains unclear if Leapmotor will offer any of its new models with the range-extender powertrain that it has recently introduced to the C10 SUV, with bosses suggesting they will be gauging market reaction to the technology.

Leapmotor's range expansion comes off the back of rapid growth for the 10-year-old brand, both in its Chinese home market and internationally.

It now has nearly 1500 retail sites worldwide and was the 11th most popular EV brand globally last year.

It aims to move up to ninth this year, then to seventh in 2026, ultimately aiming to become one of the world's five top EV brands.

Mercedes Shifts Gears: EQE and EQE SUV to End as New E-Class EV Takes...

Smart Reveals All Electric City Car for 2026 Set to Be One of Europe’s...

City car enters final stages of development; will be one of Europe's smallest electric cars

City car enters final stages of development; will be one of Europe's smallest electric cars

Smart has confirmed it will return to the city car segment with a successor to its signature model, the Fortwo, that is due to arrive late next year.

Smart CEO Dirk Adelmann last year confirmed that the project was in the works, pending a feasibility study. Following the “successful” launch of the #5 (the large electric SUV that forms the other bookend in the brand’s line-up), it has now become viable and has entered the final stages of its design and development.

It will be named #2, in reference to its ancestor and its two-seat configuration, but it will slot into Smart’s line-up below the #1 crossover, as its smallest and most affordable model.

The #2 will be designed by Mercedes-Benz and built in China, most likely at one of several plants owned by its 50:50 joint-venture partner Geely.

Technical specifications remain under wraps, but Smart has confi rmed it will be electric-only. Adelmann previously said the company was working on a new platform bespoke to the model but that the financial case for its development would hinge on finding a partner.

“The [city car] segment is not huge in Europe. The best year for [the] Fortwo was around 100,000 units, and that’s not enough to justify a platform,” Adelmann told Autocar. “If you share this platform with partners – we’re still in evaluation – then you can also share the investment costs and the production site etc, and it starts making sense.”

That the #2 has passed the feasibility stage suggests that Smart has indeed found a partner. But it is also possible that the brand has abandoned this in favour of an existing platform from the Mercedes or Geely portfolios.

The previous Fortwo EQ’s underpinnings are such an option, although one compromised by its origins in a combustion-engined model. Its 17.6kWh battery yielded a range of just 99 miles and it couldn’t charge on a DC connection, capping the rate at 22kW.

Neither figure would stand up to the competition now, but the seven years of battery development since that car’s launch surely have provided significant room for improvement.

Smart could also adapt Geely’s Panda Mini EV to meet the Fortwo brief. That car, sold in China, measures 3.0m long, has a 40bhp front-mounted motor and offers a range of up to 124 miles miles – for the equivalent of around £6000.

Visually, the #2 will do away with the curves of its Fortwo predecessors, favouring a more bluff, angular look. Teaser images published by Smart suggest it will have a Kamm tail-like rear end and a small roof spoiler, most likely to boost aerodynamics and extract the maximum range from the car’s small battery.

Porsche Teases Next-Gen 911 Turbo Hybrid With 700 HP Ahead of Munich Debut

Hyundai Unveils Bold Ioniq 3 Electric Hatchback Concept Set to Redefine Urban Driving

Striking new Concept Three will star at Munich next week, before evolving into a Cupra Born rival

Striking new Concept Three will star at Munich next week, before evolving into a Cupra Born rival

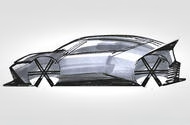

Hyundai has previewed the design of the striking electric hatchback concept it will reveal at next week's Munich motor show.

It has also revealed a name for the show car: Concept Three - which all but confirms the eventual production car will be called the Ioniq 3, and closely related to the Kia EV3 - as Ioniq 9 is to EV9.

The design sketch suggests Hyundai's hatchback will be more closely related to the rakish Ioniq 6 saloon in its styling, than the 1980s-inspired Ioniq 5 crossover or the monolithic Ioniq 9 SUV.

In profile, it resembles a race-inspired two-door sports coupé - with its stand-out features including a chunky ducktail rear wing and diffuser, aggressive front splitter, narrow wraparound lights, swollen haunches and a compact, visor-shaped glasshouse that's heavily raked - presumably in the name of aerodynamic efficiency.

As well as previewing an eventual Cupra Born rival, the Hyundai Concept Three will also serve as a showcase for the firm's new 'Art of Steel' design language, which is said to be "inspired by the way steel bends and flows, the body features sculpted surfaces, clean intersections and distinctive character lines that emphasise both motion and precision".

Hyundai confirmed the production version of the Ioniq 3 will go on sale in the third quarter of 2026, so deliveries could begin as soon as next July.

The car will be based on the same scalable E-GMP platform that is used by nearly all EVs in the Hyundai Motor Group, which comprises Hyundai, Kia and Genesis.

It's therefore likely to get a similar set-up to the similarly sized Kia EV3, which is offered with either a 58.3kWh or an 81.4kWh battery pack for ranges of 267 and 372 miles respectively. All versions of the EV3 are powered by a single electric motor that sends 201bhp and 209lb ft to the front wheels.

Inside, the new electric car will bring a “step change” in usability for Hyundai. This includes a new infotainment system that, Autocar has been told, will enable elements such as ambient lighting and noise to alter according to driving modes or chosen style.

Labor Day Brings Lowest Gas Prices in Years as Costs Continue to Fall

2026 Kia Stonic Unveiled with Striking Redesign and Upgraded Tech for the Modern Driver

Bold new look for Ford Puma rival, which gets an upmarket interior but keeps ICE power and a manual option

Bold new look for Ford Puma rival, which gets an upmarket interior but keeps ICE power and a manual option

The Kia Stonic has received a major update, bringing new exterior and interior styling and a choice of pure-petrol and mild-hybrid powertrains.

The Ford Puma and Nissan Juke rival has been revealed in Korean specification, with details of the European-spec model set to follow at a later date.

The Stonic was launched in 2017, and this is effectively a second heavy facelift for the compact crossover. Updates for the European version are likely being made to ensure it will comply with forthcoming EU7 emissions regulations.

The Stonic has received a makeover to bring it in line with Kia’s ‘Opposites United’ design, with a front end design bringing it closer to the EV3 and other new models.

The dimensions remain largely unchanged: the updated car is 4165mm long and 1760mm wide, with a 352-litre boot.

The two powertrain options that will be offered in Korea both use the 1.0-litre three-cylinder turbo petrol engine that features in the outgoing Stonic.

In standard form, it offers 99bhp and 127lb ft of torque, giving a 0-62mph time of 11.0sec and official CO2 emissions of 125-133g/km, depending on specification.

The electrically boosted mild hybrid offers and 113bhp and 127lb ft, trimming the 0-62mph time to 10.7sec and CO2 emissions to 120-129g/km.

Both powertrains are offered with a choice of a six-speed manual or seven-speed automatic gearbox.

UK specifications and figures are yet to be confirmed. The outgoing Stonic is available here with two versions of the 1.0 T-GDi engine, with varying forms of electrical assistance, both of which offer 98bhp.

Depending on trim level, 16in and 17in wheels are offered, both of which feature new alloy designs post-update.

Inside, the design changes also bring the Stonic closer in line with other Kia models, including a dashboard featuring twin 12.3in touchscreens and the multimode touch controls that can be toggled between heating and infotainment functions.

The Stonic also now offers a range of new connected functions, including a digital key option, and ADAS including blindspot monitoring, forward collision avoidance and smart cruise control.