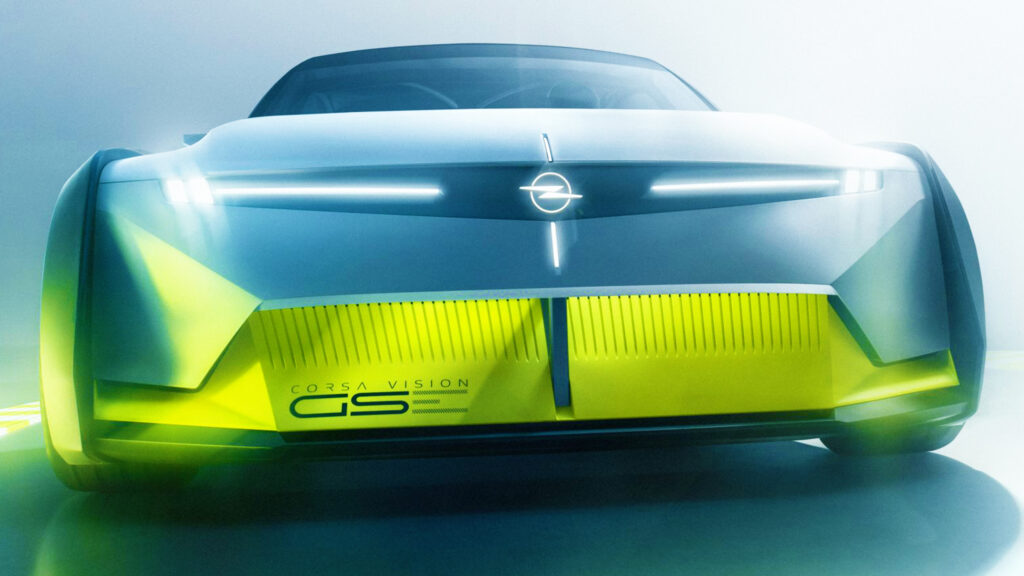

Opel Unveils Futuristic Corsa GSE Concept With Blistering Speed for Gran Turismo 7

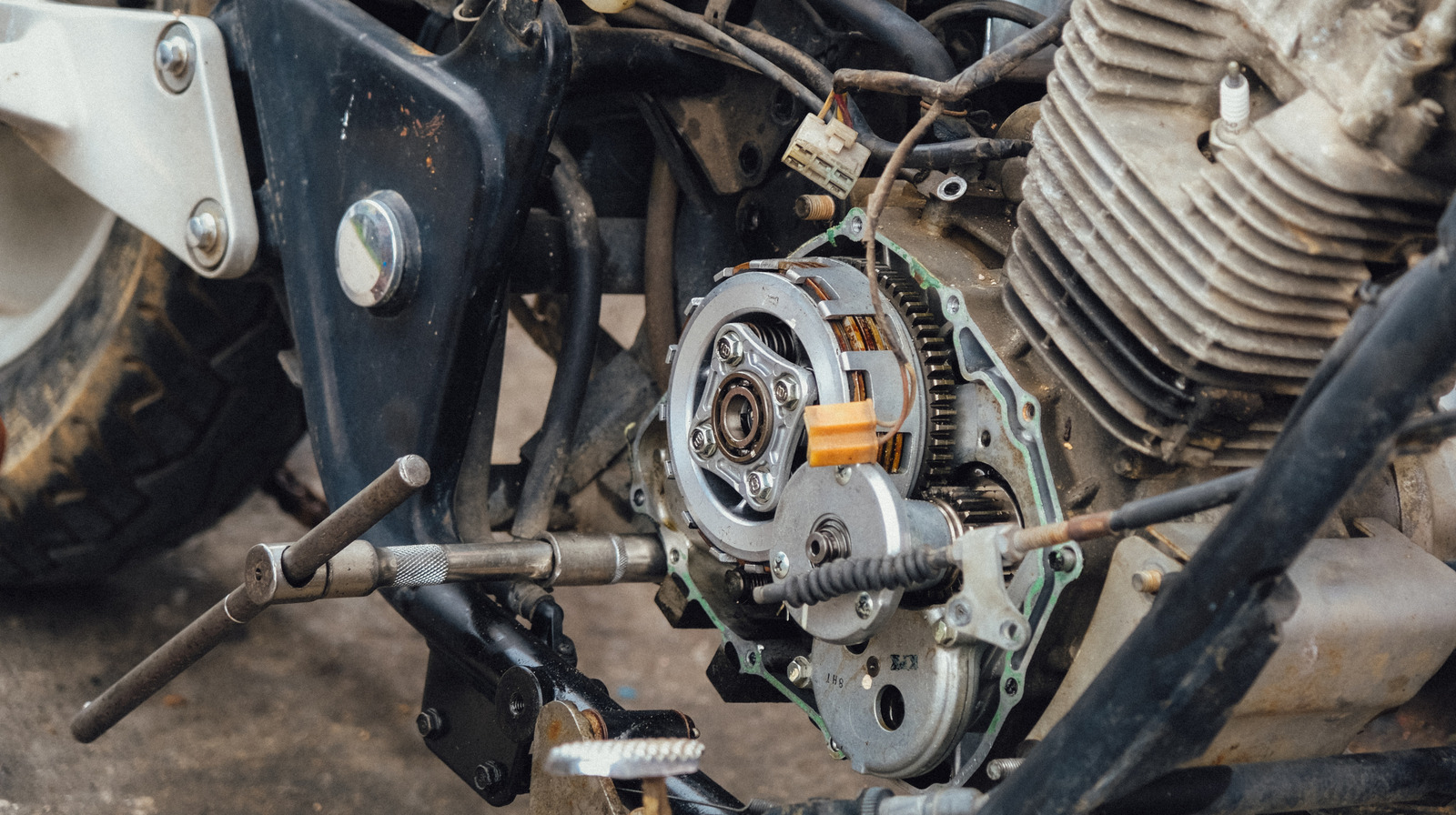

How a Slipper Clutch Protects Your Motorcycle and Enhances Performance

How Leapmotor Is Disrupting Electric Cars With Affordable Prices and Real Profits

Chinese start-up proves you can sell value-led electric cars profitably

Chinese start-up proves you can sell value-led electric cars profitably

Two recent facts revealed about Stellantis-backed Chinese electric car maker Leapmotor shouldn’t both be true at the same time but somehow are.

The first is that the company’s T03 electric runabout is now the UK’s cheapest car – £14,495 after a recent £1500 discount applied by Leapmotor to mimic the government grant.

The second is that Leapmotor posted its first-ever half-year net profit, elevating it into the very exclusive club of Chinese electric-focused start-ups to have turned margin positive. The only other member is Li Auto, a premium maker of mainly large range-extender SUVs.

Any company that can profitably sell cheap electric cars clearly points to the future of the automotive industry, so what’s Leapmotor’s secret?

Leapmotor has so far been one of the quieter Chinese car makers in terms of UK sales, with 790 registrations so far this year to the end of July. That number has been eclipsed by the likes of BYD, MG and Chery’s Omoda/Jaecoo brands, but then Leapmotor deliveries only began in April.

Along with the budget T03, the only other model it sells is the C10 mid-size electric SUV, which now has its own thread on motoring forum PistonHeads after interest was sparked by a generous private lease from as little as £161 a month (which has since ended; now it's £319 a month with £319 down).

More models are coming. The B10 compact electric SUV is poised to go on sale soon and Leapmotor chief financial officer Li Tengfei announced that the company will reveal its new B05 compact electric hatchback – a rival to the MG 4 and Volkswagen ID 3 – at the Munich motor show in September.

Along with the compact hatchback, the first of two small cars on a new ‘A-series’ platform are due next year.

While most global car makers fear the rise of low-cost electrified cars out of China, Stellantis is cheering the growth of this particular competitor. Leapmotor’s non-Chinese sales are handled by Leapmotor International, a joint venture 51% owned by Stellantis since 2023 following a deal in which the company also bought a 20% stake in Leapmotor for €1.5 billion.

“Leapmotor’s financial performance looks better than most Chinese NEV peers’,” Patrick Hummel, autos analyst at the bank UBS, wrote in a note to investors. “Stellantis made a good choice”.

Leapmotor International plans to go global, but aside from some early registrations in Latin America, the bulk of the company’s 20,370 exports in the first half went to Europe. CFO Li claimed the company booked 4000 sales in July in the region, in process claiming an impressive 1% of the fussy German car market.

The company claims it now has 550 dealerships in Europe – including over 50 in the UK and a target of 70 by the end of the year.

Neither Leapmotor nor Stellantis breaks out the profitability of the International arm. Li claimed the division is profitable but told investors that’s not the priority at this stage. “In the initial years, the most important job is to boost sales and enhance Leapmotor's global branding presence,” he said on the company’s first-half earnings call on 18 August.

The small but historically significant net profit of 30 million RMB (£3m) in the first half of 2025 came from a combination of its Chinese operations as well as a sizeable chunk (equivalent to around £20m-£30m) of carbon credits paid by Stellantis to allow it to hit emissions targets in Europe. Subsidises from the Chinese government also helped out, Li said.

Even though it was pushed over the profit line by non-traditional means, Leapmotor is doing a lot better than other start-ups like Nio, Xpeng and Zeekr, all of which are still languishing in the red.

Leapmotor started later than its competition, launching its first car in 2019. In the first half of this year, however, Leapmotor sold 221,664 cars in total, up 156%, with another 50,000 added in July. This is well below China’s leader, BYD, at over two million but above Li Auto, which posted sales of 30,731 in July.

Profitability is even more impressive, given the company’s average selling price reached just 106,000 RMB (£11,000) in the first half, according to calculations from global investment bank Jefferies.The low price reflects the punishing competitiveness in the Chinese market but also the company’s value proposition. Leapmotor has a wider range of models on sale in China, including the new B01 saloon version of the upcoming hatchback and a larger C-badged saloon.

Leapmotor's ability to make a profit from that low base reflects the fact that is vertically integrated, with 60% of the bill of materials cost coming from parts it makes itself, according to the company. Like BYD, Leapmotor produces its own batteries, which it packages into the chassis itself.

The Hangzhou-based company, born out of electronics company Dahua Technology (known best for its surveillance cameras), has channelled that know-how into creating the Leap 3.5 electronic ‘software-defined’ architecture that it ports from car to car, which, it claims, reduces the development cycle of models on the platform by 25% and the overall investment by 40%.

The big question is whether Leapmotor can remain profitable after it moves some production of B-series vehicles to Europe next year (either the B10 SUV or B05 hatchback or both). The big cost saving will be on the tariffs that Leapmotor currently has to pay on European Union imports, both on EVs and its combustion-engined range-extender models.

Moving away from China’s low-cost supply chain will increase bills but occupying existing Stellantis plants (reportedly in Spain) won’t cost too much, Li claimed. “Our overseas projects are mostly retrofit… on existing production lines. So the overall investment will be much smaller compared with greenfield projects,” he said.

Leapmotor’s low-cost, high-tech approach encompasses semi-autonomous driving and next year it claims it will be able to compete with the best thanks to improvements in lidar sensors, high-performance computer chips from Qualcomm and an ‘end-to-end’ algorithm figuring out where to place the car. As with all Chinese companies claiming leadership in this space, it’s hard to know who is actually ahead and how much the driver really can just sit back and watch as the car takes over.

This has even less relevance in the UK, where hands-free technology is tightly regulated and a new system of driver assistance is needed. As for the wider tech, one of the first customers to take delivery of the cheap-deal C10 SUVs posted on the PistonHeads forum deal thread that, after a week and 400 miles, he was "pleasantly surprised" by the experience despite the car missing out on Apple CarPlay.

The fact that Leapmotor can sell electric cars of decent quality both cheaply and – now - profitably bodes well for customers, dealers and especially for Stellantis, which gets to study how it’s done and potentially borrow some of the tech for itself.

McLaren Charts Bold Future with V8 Power and China-Exclusive Electric Supercars

2026 Nissan Leaf Delivers 303 Miles of Range With Even More Affordable Model Coming

Trailblazing Engineer Daphne Arnott Broke Barriers and Innovated Motorsport with Her Pioneering Car Company

Daphne Arnott’s company only lasted a decade, but its short existence is notable and possibly unique

Daphne Arnott’s company only lasted a decade, but its short existence is notable and possibly unique

Of all the many thousands of car makers that have ever existed, it seems probable that only one was created and operated by a woman.

Daphne Arnott’s eponymous company lasted for only a decade or so, but its short existence was an exciting and noteworthy one – and not just because of gender norms.

Arnott was born in 1926 to a father who was a third-generation automotive engineer and she was first exposed to motorsport at a young age, when he took her to Brooklands to watch a customer race using a supercharger of his.

She joined the London-based family business after a magazine publishing venture failed and became friendly with its general manager, wartime aircraft engineer George Thornton.

In 1951, the pair ventured to build a car for Formula 3, a new category for single-seaters powered by 500cc motorbike engines that had arisen from post-war austerity in Britain.

Autocar took notice when the little Arnott 500 “proved very fast” on its debut at Brands Hatch that October. It had independent suspension, partly donated by a Morris Minor, but most notable was Arnott’s focus on safety: it was the first F3 car with an integrated roll hoop and a seatbelt – not common even in Formula 1 for another 20 years.

When our sister title Classic & Sports Car caught up with Arnott in later years, she recalled: “Anyone who drove for the works team was required to use belts. Nobody was ever killed in one of our cars, and Dennis Taylor perhaps owes his life to our belts. He rolled a car at Brands Hatch but stayed in it, and when it landed on all four wheels, he continued. Had he been thrown out, he could have been seriously hurt.”

Arnott had wanted to try racing herself but “at the time there were so many restrictions on women and I wanted to compete on equal terms with the men. Most of those ladies’ races were really for the girlfriends of drivers and mechanics, and I thought they were a bit sissy.”

Naturally, her exploits caught the attention of London’s press. The Evening News wrote in 1952: “Arnott is a real mechanic. She is frequently to be seen in the pits changing a plug or helping in some other way, her white overalls grimy with grease, her blackened hands pushing carelessly through her blonde curls.” When asked if she had a romantic link to driver John Brise, she pointed to her car with a grin and said: “This is my boyfriend, and he takes up all my spare time.”

Enjoy full access to the complete Autocar archive at the magazineshop.com

The paper met her again in 1953, as her team fielded another F3 first: a fibreglass body. It weighed a third as much as an aluminium one, and she emphasised: “We kicked it around the garage and jumped on it and it seemed to make no difference.”

Meanwhile, Arnott had an eye on record-breaking, as DB, Kieft and Cooper set new 500cc bests at Montlhéry in quick order. So her team fabricated a streamlined body for the F3 car – and Brise broke no fewer than nine class records, for a fastest lap (122mph) and endurance.

Next came a road-going sports car: basically the F3 chassis clad in a fibreglass coupé body (praised by Autocar as “striking and beautifully finished”) and powered by various British fours. At least six were sold.

Ever ambitious, Arnott decided to enter a car into the 1955 Le Mans 24 Hours (painted not British racing green but her favourite colour, red). The only available driver was young Peter Taylor, and Arnott later recalled: “As he passed the pits [during practice], he simply had to give his girlfriend a nonchalant wave.

That loss of concentration caused him to clip something, the car swerved across the track and piled into the Dunlop Bridge. He was unhurt, but when I saw him get out of the car unscathed, I wanted to run across and murder him.”

It was a major blow, but Arnott’s team redoubled their efforts for a 1957 return with a bespoke coupé – and this time the innovation was, in our words, “quite the most complex suspension”, the idea being that long rocker arms would afford more grip the faster the car was cornered.

It ran okay in the race – until the fifth hour, when its Climax engine uncharacteristically shed a valve.

And that was pretty much that. Arnott refocused on the family business, taking it over after her father died in 1961. Soon after she sold up and moved to Devon to run a guest house with her husband.

She took the 1955 Le Mans car with her, though, and it has since been restored to its former glory.

Korea’s Gamified Driving Revolution Cuts Crashes but Raises Privacy Alarms

Flight Attendants Secure Landmark Victory in Labor Deal

Jaguar Land Rover Powers Up with Massive Solar Farm to Drive Sustainability and Cut...

The energy farm is the size of 36 football pitches and is part of a push to reduce grid reliance

The energy farm is the size of 36 football pitches and is part of a push to reduce grid reliance

Jaguar Land Rover (JLR) has opened a solar farm the size of 36 football pitches at its Gaydon headquarters as part of efforts to increase its energy independence.

The 26-hectare, 18MW site can generate enough electricity to power a third of the British firm’s base. The site is home to JLR’s design, engineering and R&D teams.

It is part of a move from JLR to source at least 30% of its global energy use from on-site renewables, while also reducing its reliance on grid energy – and therefore fluctuating energy costs – and improving its environmental impact.

A similar project is being completed at its Wolverhampton Electric Propulsion Manufacturing Centre. There, one of the UK’s largest rooftop arrays, featuring more than 18,000 panels, will open in the coming months.

This will be able to generate around 9500 MWh of energy each year, meeting 40% of the site’s needs.

Next year, the marque will install 10MW of solar car ports at its Merseyside site. These include canopies and solar walkways – structures like these are quite common in hotter countries, such as Spain. They will mostly provide energy for EV charging.

JLR’s chief sustainability officer Andrea Debbane said the steps were “important”. She added: “They directly reduce our global operational emissions and help move us closer to our net zero goal, whilst delivering tangible value today and for the long-term.”

Pennsylvania Car Dealer Group Fined for Deceptive Pricing in Consumer Protection Crackdown